Want to workshop a scenario?

Reach out to your local RedZed BDM - they'd love to hear from you.

Credit where credit’s due

With both full doc and alt doc options available, all of our SMSF products have variable rates, and they are available for both residential and commercial property. Whether your client contributes regularly or sporadically to their SMSF, we may have a solution!

Attractive LVRs

Up to $2M @ 70% LVR (SMSF Residential) and $3M @ 70% LVR (SMSF Commercial).

Available for residential or commercial investment properties

Your clients can use their SMSF to buy a commercial property that their business can lease, or a residential investment.

Refinance an existing SMSF loan

Improve the financial performance of their SMSF by refinancing their current SMSF loan to a better deal!

Loan servicing inside the SMSF or outside the SMSF

Your clients can make additional contributions from their income to the fund to qualify for the loan. We can even verify their income using our alternative income verification (alt doc) options.

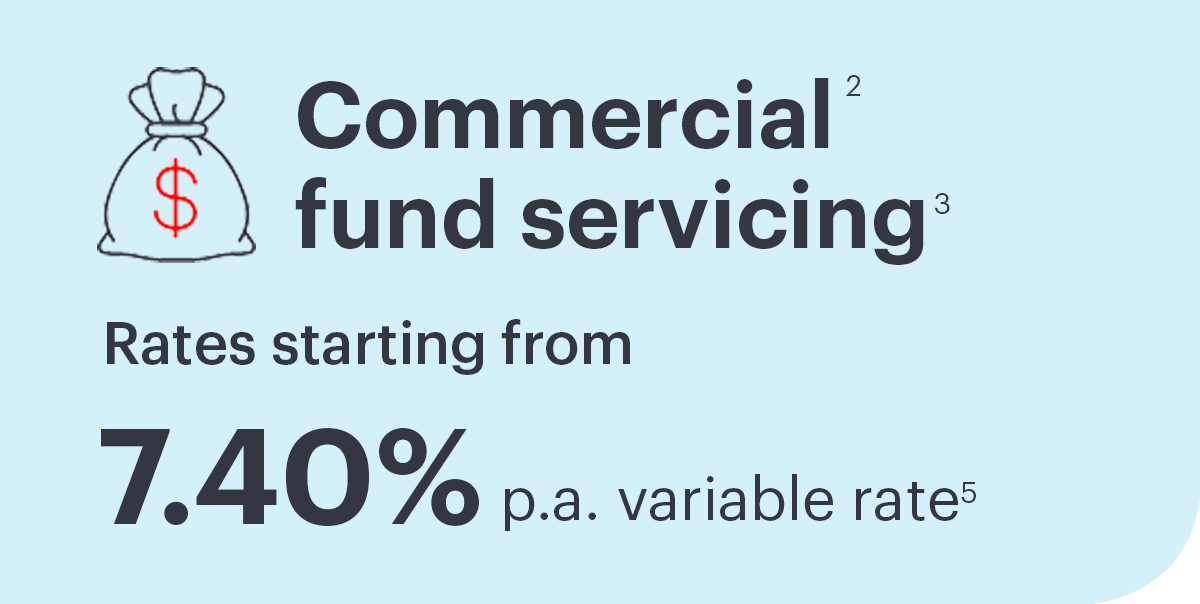

Our SMSF rates

Interest rates are correct as of 24/09/2024 and subject to change at any time. Rates depend on your client's individual circumstances, including LVR, loan amount and type of security.

|

|

1 Residential refers to the security property type. Examples include, but are not limited to, residential house, apartment, townhouse etc.

2 Commercial refers to the security property type. Examples include, but are not limited to, commercial warehouse, shopfront, industrial unit, factory etc.

3 Fund servicing is when regular verified fund contributions can be substantiated via a 12-month contribution statement, compliant SMSF financials, or SMSF rental statements.

4 Based on an SMSF Super Resi Principal and Interest loan with an LVR of 50% or less, a loan size between $100,000 to $2M and full financials provided. Corporate SMSF trustees only.

5 Based on an SMSF Super Commercial Principal and Interest loan with an LVR of 55% or less, a loan size between $150,000 to $3M and full financials provided. Corporate SMSF trustees only.

Want more details about our rates?

Head to the resources page to access our full Product & Rate Guide.

Self-employed scenarios

Have a client scenario you can't quite place? Take a look at our SMSF scenarios to see if we can provide the solution you've been looking for.

Client looking to diversify their SMSF investment portfolio?

Jason's financial planner suggests he purchase a residential property within his SMSF to diversify his investment portfolio. However all the lenders Jason approaches require tax returns to verify his contributions. Find out how RedZed was able to help Jason, without the need for tax returns.

Additional super contributions needed?

Jarrad owns an apparel wholesale business and wants to buy a residential investment property within his SMSF. However he needs to make additional contributions into his super fund to qualify for the loan. Jarrad keeps coming up against restrictive SMSF lending policies, until he rings RedZed.

Does your client want to purchase the premises their business is leasing?

Tara runs a wholesaling business and wants to purchase the warehouse her business has been leasing using her SMSF. Her tax returns aren't finalised, however this isn't a deal breaker for RedZed, as we have other ways of verifying income.